For Amanah Mpower Platinum and Amanah Mpower Credit Card-i:

For Amanah Premier World Mastercard:

What are the document required?

For salaried employees:

Multinational/public-listed companies/ government/semi-government office

How do I apply for a credit card-i?

You can apply for a credit card-i:

How do I submit my documents for credit card-i application?

Once your online credit card-i application is complete, you will get an SMS with a verification code. You can follow the instructions in the SMS to upload your documents on the HSBC website.

If you have applied for a credit card-i at the branch, all documents are to be submitted at the branch.

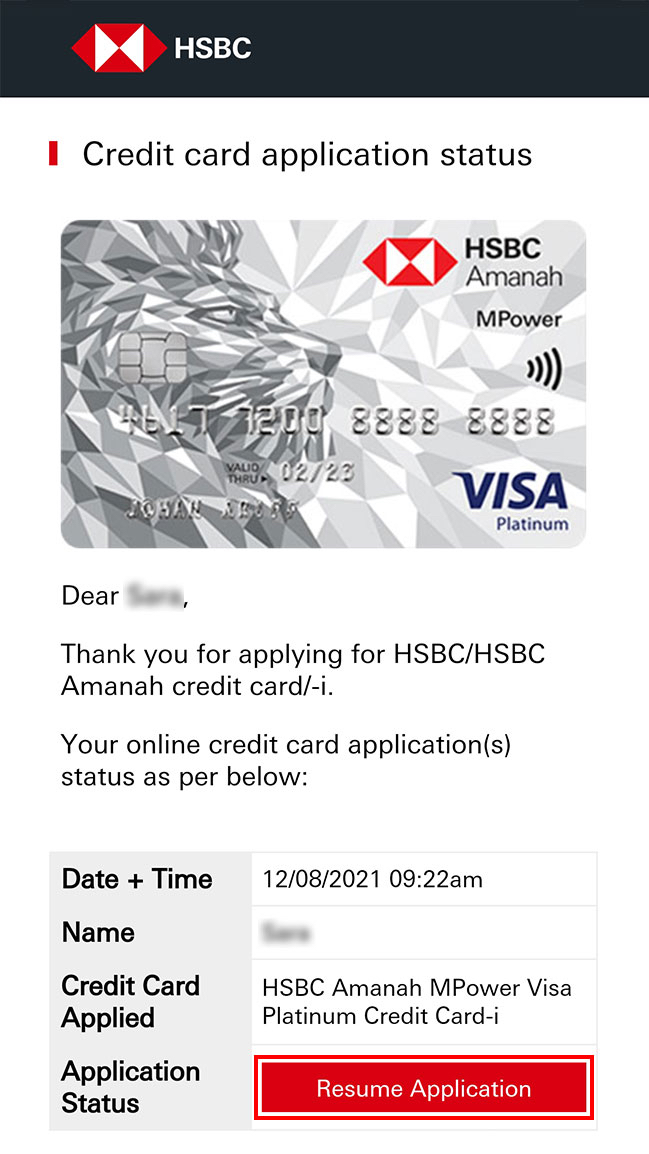

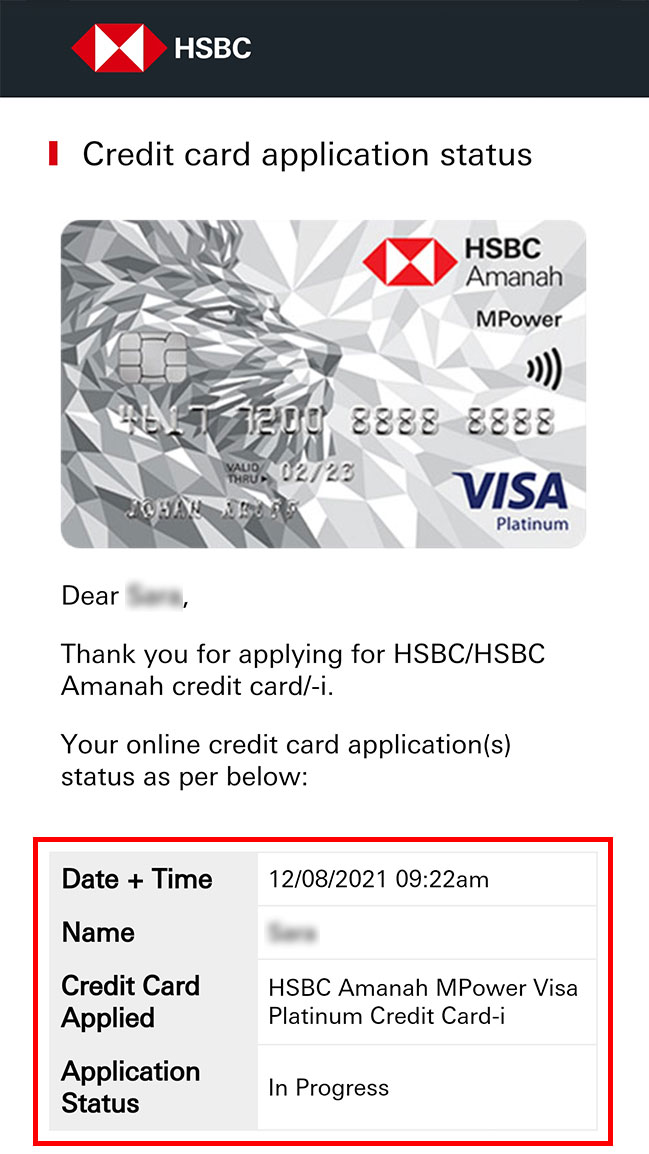

How will I know my application status?

For online applications, you'll get an SMS with a verification code once you've uploaded the documents for your credit card-i application. You can follow the instructions in the SMS to check your application status on the HSBC website.

How many supplementary cards can I apply?

Each primary customer can apply for a maximum of 5 supplementary cards.

I did not receive my credit card/-i, how can I check my card delivery status?

You can check your credit card delivery status by contacting the Customer Service Hotline.

HSBC Bank Malaysia

Local call numbers: 1300 88 1388

International call numbers: +603 8321 5400

HSBC Premier & Amanah Premier

Local call number: 1300 88 9393

International call number: +603 8321 5208

HSBC Amanah

Local call numbers: 1300 80 2626

International call numbers: +603 8321 5200

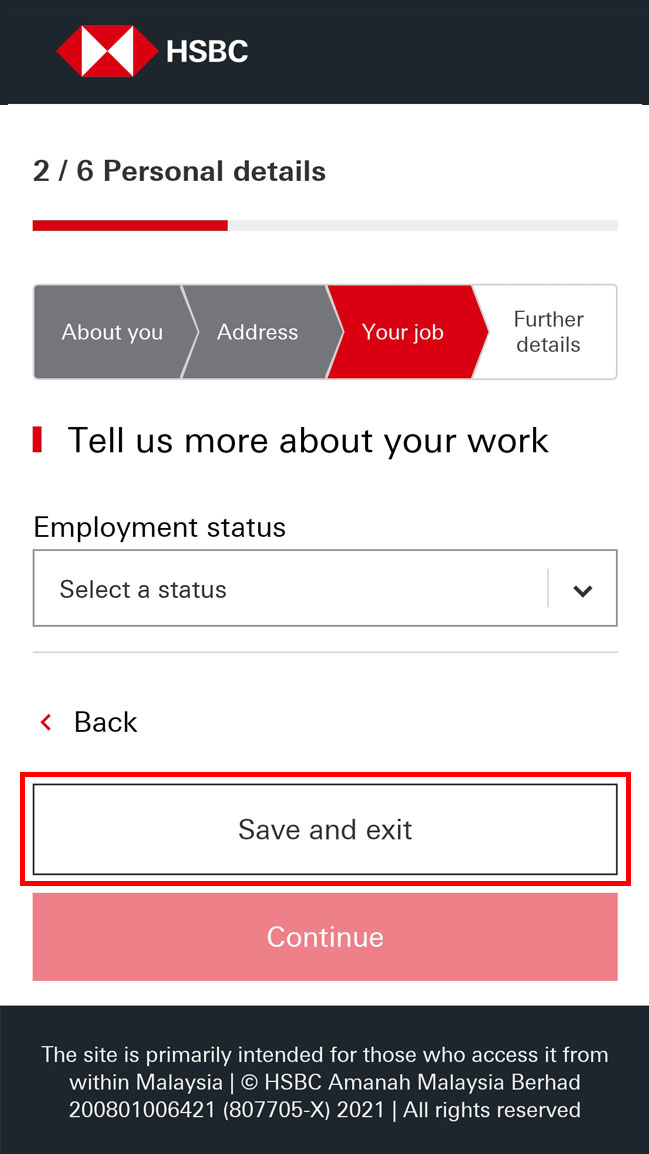

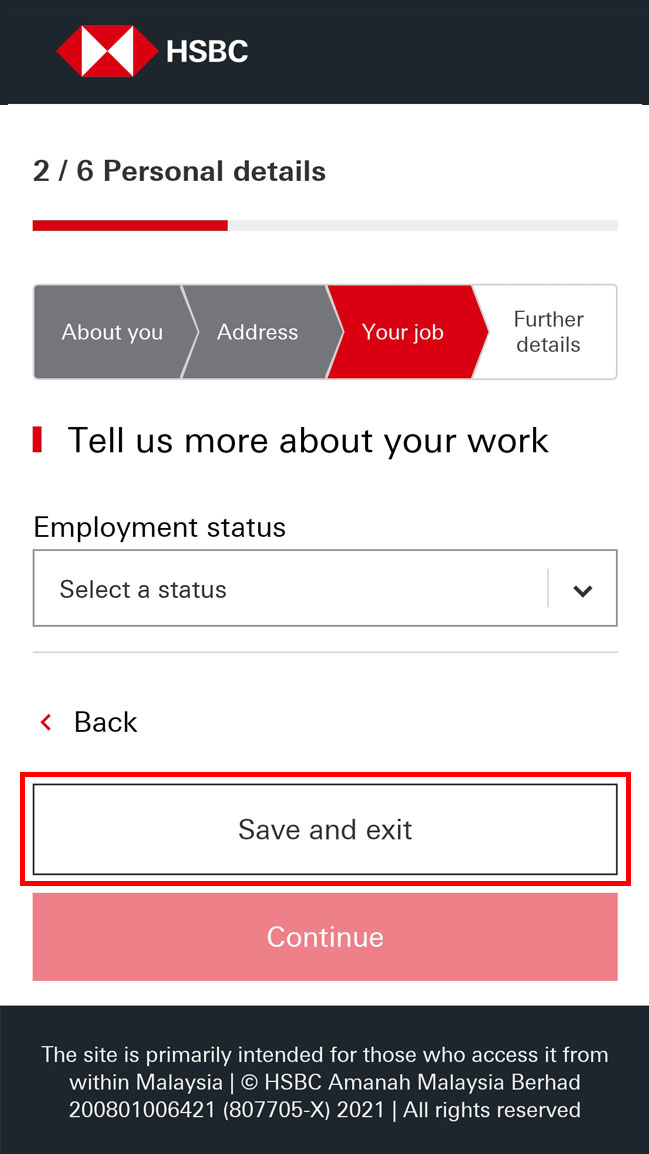

Can I save my online credit card-i application and continue it later?

Yes, you can save your application by tapping 'Save and exit' at any point after you've entered your personal details. It will be saved for 90 days before being deleted.

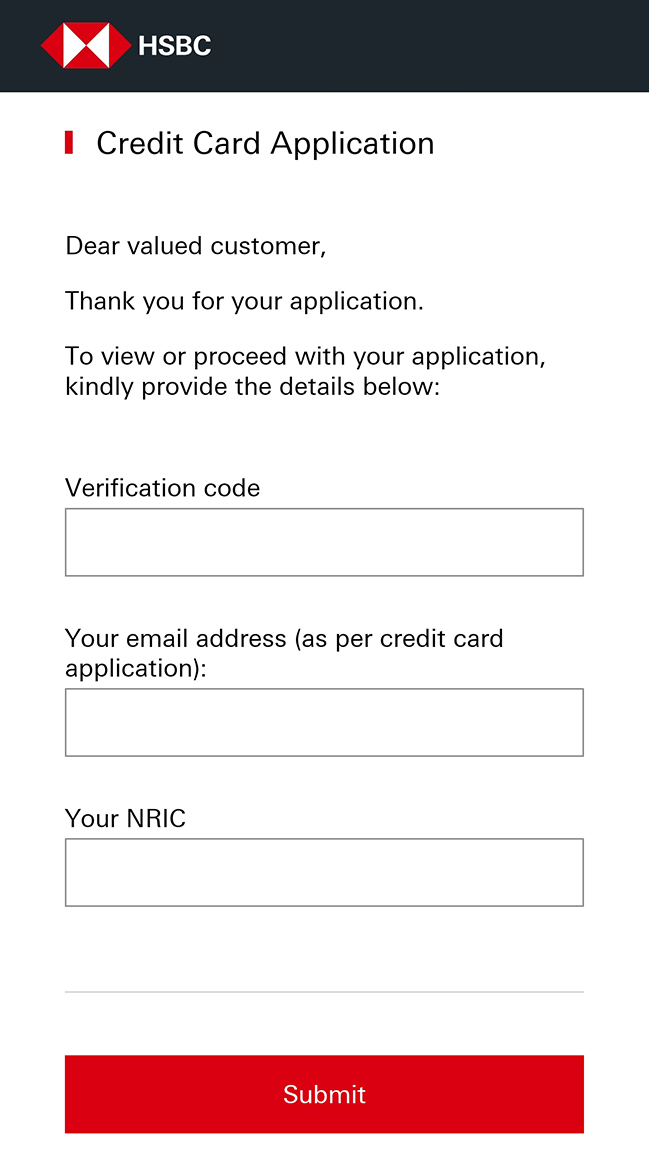

How do I resume an online credit card-i application that I have saved?

After you tap 'Save and exit', you'll get an SMS with a unique verification code.

To resume your application, go to the HSBC website. Select 'Credit card-i', then 'Resume/track application'. Next, follow the steps on the screen to verify yourself. You'll then be able to check your application status and continue with your application.

How do I check my credit card-i application status online after submission?

Once you've submitted your application, we'll send you an SMS with a verification code.

To resume your application, go to the HSBC website. Select 'Credit card-i', then 'Resume/track application'. Next, follow the steps on the screen to verify yourself. You'll then be able to check your application status.

Why didn't I receive a text message after submitting my online credit card-i application?

If you did not receive any text message after submitting your full application, you might have entered an incorrect mobile number. Please call our contact centre for assistance.

Why do I see multiple online credit card-i applications when I check my status?

If you start new applications with the same name, email address, contact number and identification number, they'll show up as duplicate applications. If you see an application that does not belong to you, please contact us immediately.

When can I check my credit card-i application status?

You can check your credit card-i application status one day after your submission. You can view your application for 90 days from the date of your submission.

How do I upload documents for applications I've submitted online?

You'll get an SMS with a verification code. To upload your documents, go to the HSBC website, select 'Credit card-i', then 'Upload document'. Next, follow the steps on the screen to verify yourself. You'll then be able to check your application status.

You can call our 24-hour Card Activation & PIN hotline on (+603) 8321 8999 using your registered mobile number and follow these instructions.

Step 1. Press '1' for credit card/-i activation & PIN.

Step 2. Press '1' to activate credit card/-i.

Step 3. Enter the 16 digits of the credit card/-i number that you wish to activate followed by the '#' key.

Step 4. Enter the card/-i expiry date in ‘MMYY’ format.

Step 5. Enter the 6-digit OTP, which will be sent to your registered mobile number.

Step 6. Your credit card/-i will be activated within 2 hours. Please wait for the SMS confirmation before using your HSBC credit card/-i.

Step 7. If you want to activate another credit card/-i press '1', OR press '2' if you want to create the PIN (Personal Identification Number) for this activated credit card/-i.

What should I do if my credit card-i is lost or stolen?

You can temporary block/unblock your card via HSBC mobile banking app. Find out how

How can I change my HSBC credit card-i PIN?

You can call the credit card-i PIN hotline at +603 8321 8999 from your registered mobile number to change your PIN.

How do I make an online payment to my HSBC credit card-i?

You can make online payments via the HSBC Online Banking and HSBC Malaysia Mobile Banking app.

How do I increase/decrease my HSBC credit card-i credit limit?

You can request for a higher credit limit on your credit card-i to enjoy extra financial flexibility and better manage your spending on the things you love. There are a few ways to do it:

Online banking

It's easy to increase of your Credit card-i limit online.

Complete the online form and one of our representatives will contact you on the next working day to complete the submission.

By phone

You can also request to increase your Credit card-i limit by giving us a call.

-HSBC Premier customers can contact your Premier Relationship Manager to arrange an appointment.

-All other HSBC customer can call 1300 80 2626 (+603 8321 5200 if you are overseas).

To decrease your Credit card-i limit, call 1300 80 2626 (+603 8321 5200 if you are overseas)

What should I do if there are transactions charged to my card which were not authorised by me?

If you notice a suspicious charge or didn't authorise a payment, here's how to raise a dispute.

If you don't recognise a transaction

There can be a number of reasons why your statement contains a charge that you don't recognise. Here are some possible explanations that might help you identify the transaction:

Check the retailer's name

Retailers are sometimes registered under a different name, so the one on your statement might not be what you expect. Try looking up the name on the internet to see if you can find more details on it.

Look out for additional charges

Some retailers, such as hotels, taxis, airlines or hired car services, can add additional surcharges to your basic payment package.

Check your receipts and your email inbox

Also, have a look at your email inbox, as you'll often get digital confirmation emails or receipts, and these might also contain the retailer's registered name.

Adjacent transactions

Check other transactions appearing on your statement with a similar timestamp. This may remind you of where you were when the transaction was made.

Consider exchange rates

If the transaction you don't recognise was made in a foreign currency, the final amount could be different to the amount at the time of your purchase. For refund transaction, the refund amount in Malaysia Ringgit could be different to the amount of your purchase.

Check with your supplementary cardholders

If you have supplementary cards under your account, ask if the supplementary cardholders might have made the transaction.

Check recurring payments

It could be that the transaction is part of a series of ongoing payments such as an autopay.

Free trials

If you signed up for a free trial recently, check the free trial period and its corresponding terms and conditions. The free trial could have expired, and you may now be paying for the goods or services.

How can I raise a dispute for the transaction(s) charged to my card?

First steps

In most cases you'll need to try and solve the problem by first contacting the retailer. If that proves unsuccessful, then you may contact us to raise a query about the transaction.

Contact us quickly

It's important that you contact us as soon as possible once you know that there is an issue. You'll need to raise a dispute within 60 days after the statement date (unless the merchant has closed down) so we have sufficient time to process your dispute request.

You can contact us using one of the following ways:

By phone

You may make a dispute request by calling our customer service hotline

Local Call Numbers: 1300 80 2626

International Call Numbers: +603 8321 5200

Online submission

How long does it take for the dispute to be resolved?

Under the scheme rules of respective Credit card-i associations, the process normally takes about 45 to 90 calendar days to complete.

Will I be informed if my dispute has been resolved?

Yes, you will receive an SMS notification if the transaction is accepted. Otherwise, a rejection letter will be issued for dispute transaction without chargeback rights.

Who can assist me on queries regarding disputes?

You may make a dispute inquiry request by calling our customer service hotline:

Local call numbers: 1300 80 2626

International call numbers: +603 8321 5200

We may review your credit card/-i account(s)' credit limit from time-to-time. After we assess the credit risk associated with your credit card/-i account (including your spending or repayment/payment patterns), we may decide to increase or reduce your credit limit.

It is our responsibility to ensure that our financing products are suitable and affordable for your financial circumstances. They should not increase your financial burden.

Can I request to postpone the reduction of my credit card/-i credit limit?

No, this is not allowed. Your credit card/-i credit limit is subject to our credit risk assessment. However, we will give you at least three (3) banking days' prior notice of any change.

I have been paying my credit card/-i on time recently. Why is my overall credit performance not satisfactory?

Your overall credit performance is based on records over a longer period of time and across all products you may have with us.

What can I do to avoid having my credit card/-i's credit limit reduced in the future?

Make sure you always make at least the minimum payment to your credit card/-i and any other HSBC / HSBC Amanah facilities before the due date. Having a history of consistent repayment/payment will help in your credit performance.

Can I object to the bank's decision to reduce my credit card/-i credit limit?

Your credit card/-i credit limit is subject to our credit risk assessment. However, we will give you at least three (3) banking days' prior notice of any change.

Can I appeal to the bank's decision to reduce my credit card/-i credit limit?

Sorry, we do not accept any appeal request. However, you may apply for a credit limit increase after 6 months from the date your credit card/-i's credit limit is reduced by submitting your latest income documents via branch or contact our customer service.

How soon I can request a credit limit increase?

You may apply for a credit limit increase 6 months after the date your credit card/-i’s credit limit was reduced. To apply, you'll need to by submit your latest income documents at a branch or contact our customer service.

I'm currently having difficulties in paying my credit card/-i's monthly payment. Can you help me?

We currently offer multiple solutions to help you if you cannot meet your monthly payments. If you would like help, please call the customer service hotline on the back of your credit card/-i.

Additionally, you may seek the services of Agensi Kaunseling Dan Pengurusan Kredit (AKPK), an agency established by Bank Negara Malaysia to provide free services on money management, credit counselling, financial education and debt restructuring for individuals. AKPK can be reached at 1-800-88-2575 or www.akpk.org.my.

How can I check my CCRIS record?